Use Pandas to Automate Intercompany Transactions

Intro and Preparation

This post demonstrates how we can use Python and Pandas library to help us do intercompany transaction journal entries automatically. The scenario and the requirement in this post is easy to understand. In real life, it can be more complex and need extra lines of codes to be solved.

For those who just want to see the codes, please click here.

To use this code to automate your accounting process, you should have:

- Python3 installed

- Pandas library

To make it easier to test and use your code, you can have

- Jupyter notebook

- Sublime Text

- Pyinstaller (to give this code to your colleagues who have no programing experience)

Scenario

You can quickly scan through or skip this part if you are well knowledged in intercompany transaction.

Bill

We have expenses incurred in one subsidiary.

For example, Lisa, a marketing specialist of your company, is going to host a large marketing campaign in US for the development of US business. She spent some money on this campaign so you can record it in the expense system like this.

| Sub | Account | Debit | Credit | Explanation |

|---|---|---|---|---|

| DE | Campaign Expense | $10,000.00 | Bill | |

| DE | Account Payable to Credit Card | $10,000.00 | Bill |

Memo: Lisa’s campaign cost in U.S. (Lisa is a DE employee)

We assume the above has been fully automated and the below has yet to be automated.

Intercompany Transaction Journal

However, because Lisa is not an employee from your US subsidiary but an employee from your German subsidiary, these expenses are actually paid by DE. For some reasons, she spent this money out of her pocket or from her German Corporate Credit Card. So this bill is recorded back to her own company - the German subsidiary.

Based on the above bill, the global accounting team needs to record an intercompany transaction journal, which includes four lines of entries, to transfer this expense from DE to US:

| Sub | Account | Debit | Credit | Explanation |

|---|---|---|---|---|

| DE | Account Receivable from U.S. | $10,000.00 | Intercompany Transaction | |

| DE | Campaign Expense | $10,000.00 | Intercompany Transaction | |

| US | Account Payable to DE | $10,000.00 | Intercompany Transaction | |

| US | Campaign Expense | $10,000.00 | Intercompany Transaction |

Memo: Lisa’s campaign cost in U.S.

Requirement

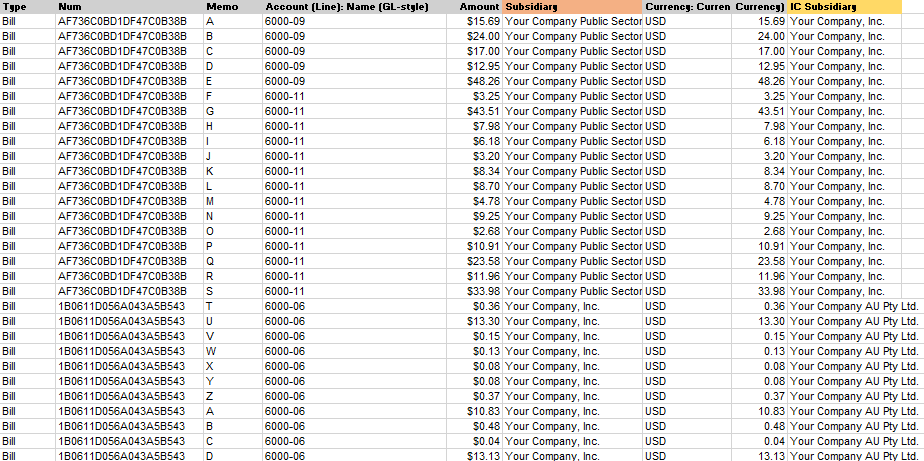

In words, generate IC transactions and save them in a csv according to the ‘Subsidiary’ marked red and the ‘IC Subsidiary’ marked yellow.

Click here then click ‘download’ or ‘view raw’ to find the Excel file. (rest assured that this file does not include any macro)

What we need to do is to transform the bill entries in the Excel file into IC transactions in csv format.

Specifically:

- Given a long list of bill items, classify them into different groups according to:

- IC (intercompany) from subsidiary, the employee payroll sub – it’s DE in the above case

- Bill reference number – unique key for bills

- IC to subsidiary – it’s US in the above case

- Create core function to transfer bills into IC transactions

- Apply core function to each above group to create IC transactions

- For each “IC from subsidiary”, create a csv file

Solution

To view the explanation and solution code in a Jupyter notebook, click here.

To view the code in a python file, click here.

To test the solution, put the python file or jupyter notebook and the Excel file in a same directory and run the codes. You will find several csv files generated in the same directory.

Cheers!

With some extra knowledge, we can always automate boring and repetitive jobs. Let’s release our brain from the messy tasks and do some innovations. Cheers! :)